canadian tax strategies for high income earners

My marginal tax in Alberta this year will be in the second highest bracket - combined Federal Provincial to be 47. Spousal Registered Retirement Savings Plan Spousal RRSP Flow-Through Shares.

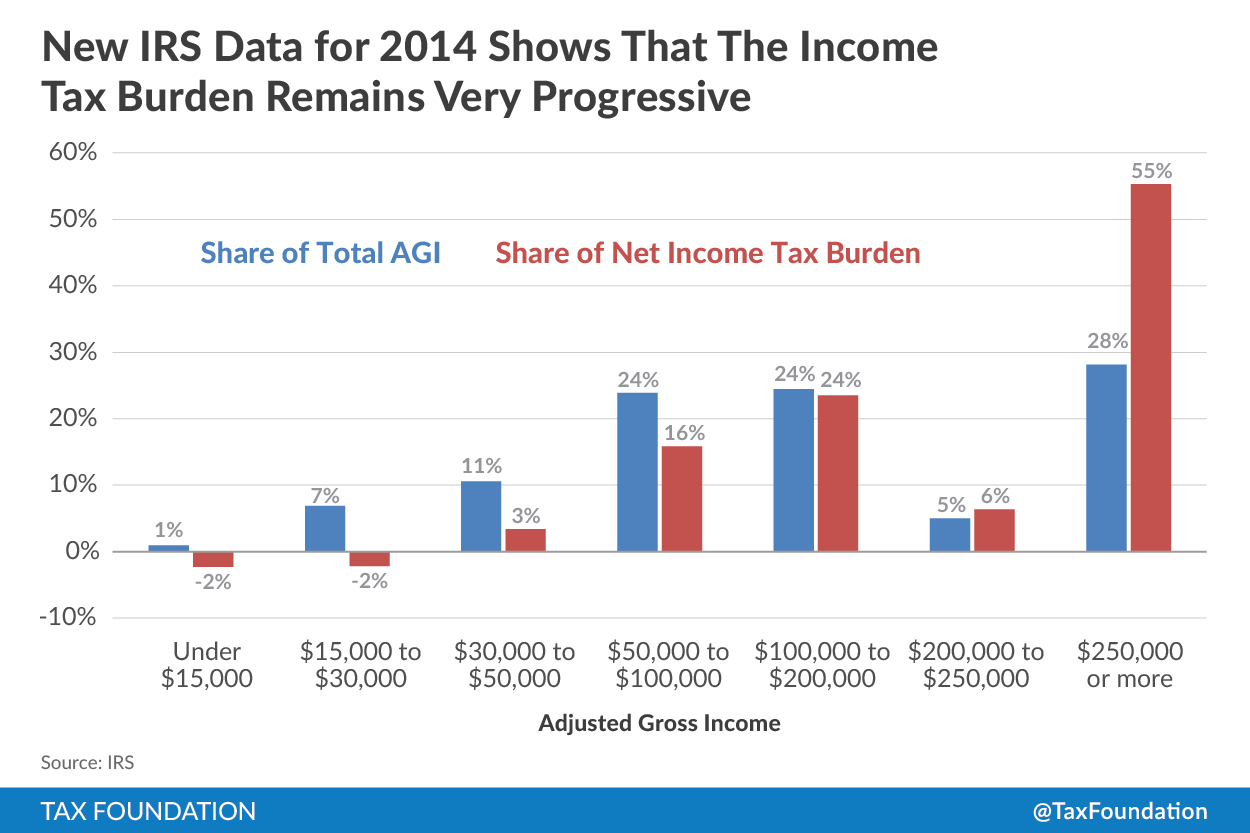

Millionaires And High Income Earners Tax Foundation

Here are a couple of tax planning strategies that will be highly effective for you.

. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. This is done through shady accounting practices or stashing money in offshore accounts in tax-havens like the Caribbean. Tax Planning Strategies for High-income Earners.

Eliminate the 20 percent long-term capital gains tax. Donate More to Charity. Tax Planning for High Income Canadians.

Every Canadian has access to a few different tax-sheltered. This is one of the most important tax strategies for you as a high-income earner. One of the most frequently used techniques to lower a high-income earners tax liability is.

While income splitting between family members may no longer be viable the new rules do not prevent higher income spouses from. AG Tax professionals have prepared a list of certain tax. Its never too early to start tax planning for the New Year.

If you wish to save tax. Here are some of our favorite income tax reduction strategies for high earners. Everyday tax strategies for Canadians.

Tax deductions are expenses. One of the most popular tax-saving strategies for high-income earners involves charitable contributions. Utilize RRSPs TFSAs RESPs to the max.

Many wealthy Canadians run a side business or their own business for the benefits of lower tax rates business write-offs and tax-deductible. What are some options for high income earners to save on taxes. A family with two adults and three children will also have a very high tax rate.

If theres potential for a high return by. Family Income Splitting and Family Trusts. With your qualified tax advisor.

Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. The Canadian Dividend Tax Credit is an excellent way to reduce your taxable income if you hold dividend-paying stocks. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio.

Under RS rules you can deduct charitable. Only dividend income from recognized Canadian. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax.

When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden. Health Savings Account Investing. Done properly tax planning has the potential to minimize tax obligations.

The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government. This is one of. In this way the net income from the.

That is why we suggest that you read our Ultimate Guide for the best tips to find the right financial advisor for you. Buying assets in your partners name. For this strategy to be effective your partner must have a lower marginal tax rate than you do.

These changes are significant because they make it possible for high-income earners to make additional contributions to a retirement plan during the tax year. High income earners not only have to contend with higher marginal income tax rates but also the potential of paying Medicare surtax and net investment income tax NIIT. Taking advantage of all of your allowable tax deductions and credits.

5 things to get right.

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Planning For High Income Canadians Mnp

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GYBRY3DQFBBRJAVNF6VR7WBC4U.jpg)

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail

Personal Income Tax Brackets Ontario 2021 Md Tax

Liberals To Go Further Targeting High Income Earners With Budget S New Minimum Income Tax Getarticlestoday

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

High Income Earners Need Specialized Advice Investment Executive